Tesla Is Still Down 25% in 2024 Despite Its Monster Jump. Is the Stock a Buy?

Being a Tesla (NASDAQ: TSLA) shareholder isn't for the weak stomach. The company's stock movements can be erratic, and many people may worry if they're not used to the volatility.

Tesla's stock popped more than 10% the day after its recent earnings release. However, since the start of 2024 the stock is still down over 25%.

So, is this pop the start of a new bull run for Tesla? Or is it an overreaction?

Tesla's Q1 results were disappointing to many investors

When analyzing Tesla, the first fact is that the stock does not trade solely on how the business is currently doing. Instead, Tesla's future projects and product launches are given a lot of weight.

This becomes evident when you look at the company's first-quarter results, which weren't great.

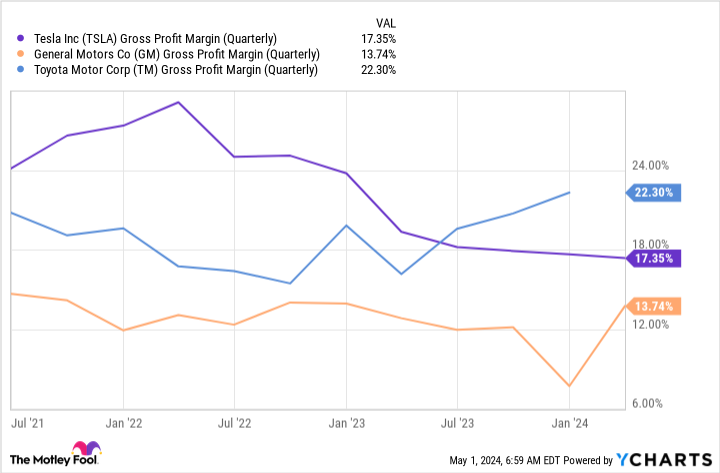

Revenue was down 9% year over year, and its gross margin decreased from 19.3% to 17.4%. This continues a concerning trend, as Tesla's gross margin used to set it apart from other auto manufacturers. Now, it's in line with others.

Declining revenue and shrinking margins weighed heavily on Tesla's earnings per share (EPS), which declined 53% year over year to $0.34. Perhaps the most concerning metric is that Tesla's free cash flow fell into negative territory, meaning Tesla is now burning cash to function as a business.

This is all troublesome to investors, but the newest information on the conference call made many investors look right past these poor results.

New products have investors excited

Tesla investors envision an all-electric vehicle fleet with Tesla as the dominant player in the space. This vision also includes new technologies like automated taxis and semitrucks, although those are just ideas on paper right now.

However, investors are about to get a look into one of these technologies in a few months.

In August, the world will get its first look at Tesla's robotaxi, which it calls the Cybercab. A lot hinges on this release, as a part of Tesla's current valuation likely includes capturing the people-and-goods transportation market.

Tesla also hinted at updating its product launch roadmap. Previously, Tesla expected these new vehicles to arrive in the second half of 2025. Now, it expects them in the first half of 2025 or even late this year. This new round of vehicles will include a "more affordable model," which many investors have been waiting for. If Tesla can mass produce an electric vehicle cheaply, it may entice more drivers to buy one that is only suited for commuting shorter distances rather than long trips.

The investor's vision of what Tesla can be is shaping up, and we'll have a lot more information by this time next year. However, the current status of Tesla's business is a bit troublesome.

So, should you buy the dip? I'd only say "yes" if you're a Tesla believer. It isn't a bad thing to be a believer, as Tesla's vision is quite impressive. However, if the world is more hesitant to switch to an all-electric fleet, this vision may not have the financial means to support Tesla's valuation, even if its product launches are all successful.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Tesla made the list -- but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of May 6, 2024

Keithen Drury has positions in Tesla. The Motley Fool has positions in and recommends Tesla and Uber Technologies. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

Tesla Is Still Down 25% in 2024 Despite Its Monster Jump. Is the Stock a Buy? was originally published by The Motley Fool