How much money does the UK government raise and spend each year?

- Published

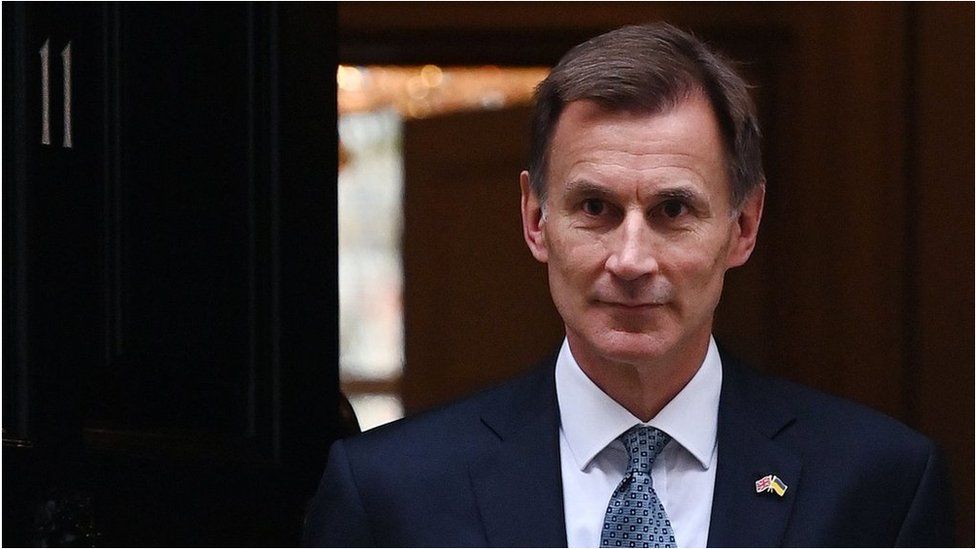

Chancellor Jeremy Hunt has laid out the government's plans for taxation and spending in the Autumn Statement.

How much money does the government have to spend, and where does it come from?

How much money does the government raise?

The government raises and spends more than £1 trillion a year. A trillion is £1,000bn, or a one with 12 zeroes.

Such a big number is hard to picture, but for that money you could comfortably buy the UK's 10 most valuable companies. It's about £15,000 per person in the UK.

It is the chancellor's job to oversee the collection and distribution of this money.

Where does the government's money come from?

About a quarter of the money the government expects to raise this year will come from income tax, which people pay on the money they earn.

The amount of money the government makes from income tax is expected to rise in the coming years.

This is because the amount you are allowed to earn before you have to pay income tax has been frozen until 2028. The point (threshold) at which people start paying higher rates of tax has also been frozen.

The rate of National Insurance will be cut from 12% to 10% from January. The government says this means it expects to raise £2.2bn less from NI this year.

However, the independent Office for Budget Responsibility (OBR), which makes forecasts for the government, says the amount of money made from all taxes so far this year is higher than expected.

New versions of the figures used in the charts below have not yet been released by the government to take these changes into account.

The next two biggest earners are VAT, which is paid on many purchases, and National Insurance, which is another tax levied on people's earnings.

The tax categories described as "other" are also relatively large. These include capital gains tax, stamp duty and vehicle excise duty.

The OBR said that measures in the Autumn Statement had reduced the overall level of tax as a proportion of the size of the economy.

Nonetheless, it said that figure would still rise in each of the next five years to a post-war high of 38% of GDP.

Some sources of money for the government don't come from taxation, such as student loan repayments, which are included in the "other non-taxes" category.

What does the government spend money on?

Social protection spending is by far the biggest outgoing for the government, accounting for more than a quarter of all its expenditure.

This includes the cost of benefits paid to pensioners as well as benefits to working-age people.

If you look at what has happened to these since the Conservatives came to office as part of a coalition in 2010, spending on pensioner benefits is worth about the same proportion of the economy as it was. However, working age benefits are worth less.

About a fifth of government spending goes on health. Health spending has been rising for decades, because of the growing cost of looking after the UK's ageing population, and increased spending on treatments.

The next biggest area of spending is education, which was cut in the 2010s and has been recovering since.

After this comes the cost of interest on the debt the government has borrowed.

Spending on debt interest has increased considerably - that's the amount the government has to pay for all the money it has borrowed. The interest is about 50% higher as a proportion of the size of the economy than it was in 2010.