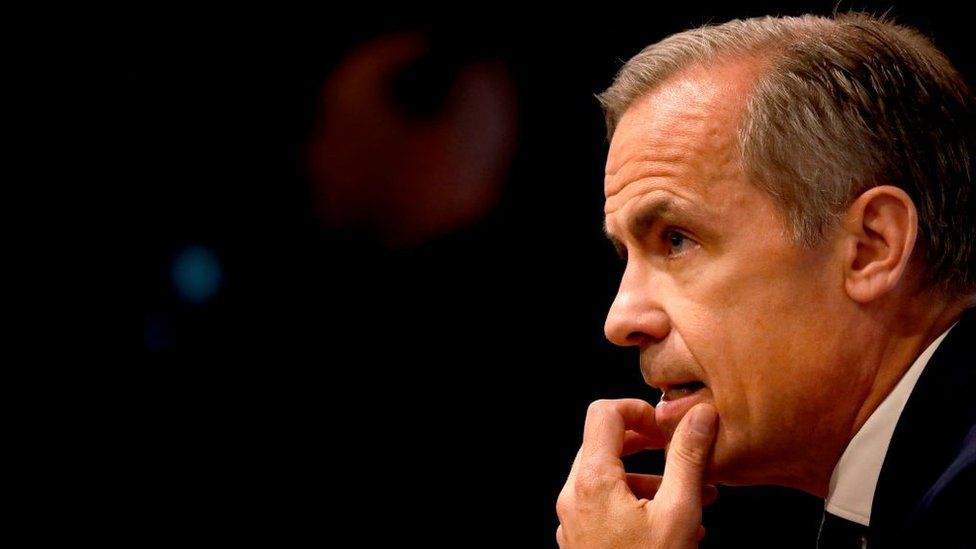

Brexit: UK economy not ready for no deal, Mark Carney says

- Published

- comments

Large parts of the British economy are not ready for a no-deal Brexit, Bank of England governor Mark Carney has said.

Fewer than half of businesses have initiated contingency plans, Mr Carney told BBC Radio 4's Today programme.

He said the UK would need a transition period to adapt to whatever form of exit from the EU that Parliament chose.

He denied that the Bank's warning that no-deal could lead to a UK recession was intended to scare people into backing his favoured form of Brexit.

Ports and borders

Mr Carney told the BBC that "we know from our contacts with business, others know from their contacts, that less than half the businesses in the country have initiated their contingency plans for a no-deal Brexit".

"All the industries, all the infrastructure of the country, are they all ready at this point in time? And, as best as we can tell, the answer is no," Mr Carney said.

It is in the interests of the country that there should be a transition to whatever new relationship the UK has with the EU, he said.

He added: "We know issues around the borders, we go to the ports and we know the issues that are there today. So we need some time to get ready for it."

On Wednesday, MPs warned that there was a "real prospect" of "major disruption" at UK ports in the case of a no-deal Brexit, with government plans "worryingly under-developed".

However, the Department for Transport said the Public Accounts Committee's conclusions "were not accurate".

'Real opportunity'

Conservative MP and Brexiter Jacob Rees-Mogg accused Mark Carney of talking down the pound on Wednesday, saying the Bank of England's warnings tonight "lack all credibility".

Mr Rees-Mogg said "project fear" had become "project hysteria".

"The overwhelming majority - 87% - of British companies do not trade with the European Union," he said.

"It will not have an effect on them. Leaving the European Union is a real economic opportunity and it's an opportunity that neither the Bank of England nor the Treasury in its forecasts wishes to recognise," Mr Rees-Mogg added.

Mr Carney's comments come after government forecasts warned that the UK would be economically poorer under any form of Brexit, compared with staying in the EU.

Under Theresa May's Chequers Brexit plan, the UK economy could be up to 3.9% smaller after 15 years compared with staying in the EU, government analysis suggested.

With a no-deal Brexit, the hit to the economy would be 9.3%.

"Our deal is the best deal available for jobs and our economy, that allows us to honour the referendum and realise the opportunities of Brexit," Mrs May said at Prime Minister's Questions.

The Bank of England, meanwhile, said on Wednesday that the UK economy could shrink by 8% in the immediate aftermath of Brexit if there was no transition period, house prices could fall by almost a third, and that the pound could fall by a quarter.

'Significant uncertainty'

The UK's financial regulator, the Financial Conduct Authority, has said the risks of the draft Brexit agreement were "preferable to the risks of a no-deal scenario".

"Leaving the EU creates a number of risks for us regardless of the form of exit," the FCA said in a report.

"The implementation period helps address these at the cost of a lower ability to influence regulation during that period. An exit without agreement would carry much higher risk and carry significant uncertainty for us and for firms.

"Against that background, and viewed through the lens of our statutory objectives, the draft Withdrawal Agreement and the outline political declaration are preferable steps."

The FCA was asked by the Treasury Select Committee to consider the impact of Brexit in three areas: a no-deal scenario; the draft withdrawal agreement; and the outline political declaration on the future relationship between the EU and UK.

In a letter to the committee's chairman, Nicky Morgan, FCA chief executive Andrew Bailey said a no-deal scenario "would create significant challenges and risks in terms of firms' readiness, potential market disruption and insufficient public-policy solutions put in place on the side of the EU".

- Published28 November 2018

- Published28 November 2018

- Published28 November 2018