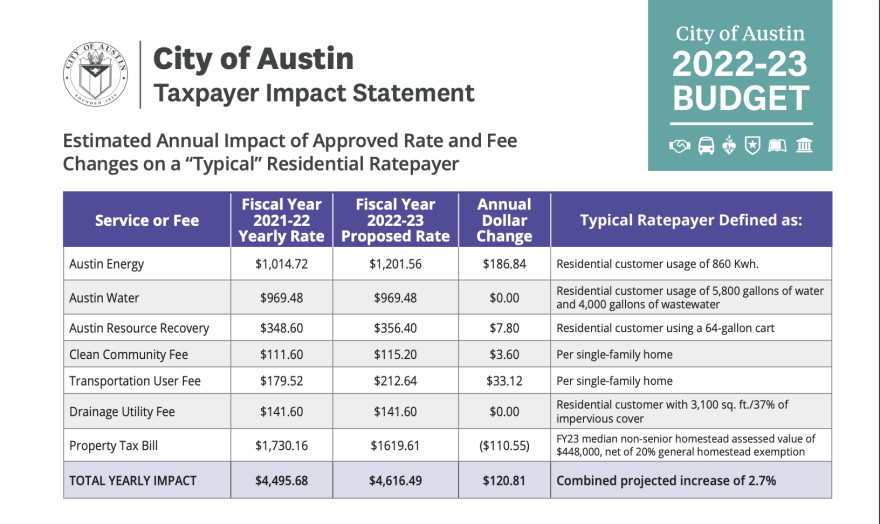

Austinites may not see as steep a hike in property taxes next year. Still, they could see an increase of 2.7% in both taxes and city fees under a budget proposal released Friday.

City Manager Spencer Cronk's proposed $5 billion budget for 2023 leans more heavily on city fees for services like electricity and trash pickup — not on property taxes, as it has in previous budget cycles.

At an announcement at the Montopolis Recreation Center on Friday, Cronk said the average household would see a $10 monthly increase in city property taxes if the proposal gets the OK from City Council in August.

This year’s proposal continues a recent trend of property tax increases. Homeowners could be taxed 45 cents per $100 of taxable value on a property, a 3.5% percent increase over last year.

State law puts a cap on property tax increases allowed by cities, which requires a citywide vote on proposed tax rates that increase above 3.5% annually.

"For the first time since the pandemic hit and the state revenue cap has been in place, our five-year projection ... indicates balanced budgets over each of the next four years and only a nominal deficit in year five," he said. "Obviously, these are only projections, and given the tumultuous few years that we've all lived through, we would be wise to expect the unexpected."

All told, the city says taxpayers can expect an overall increase of 2.7% on their monthly bill for taxes and services.

Under Cronk's proposal, Austin would lean more on city service fees, like those charged by Austin Energy. The city-owned utility is in the midst of raising rates for residential users. The long-telegraphed move aims to shore up an estimated $48 million revenue gap, but opponents argue it largely targets residential customers using the least amount of energy and discourages renewables.

A large chunk of the overall budget goes toward Austin Energy, but its fees also account for roughly a third of the city's revenue. The city expects the rate increase will lead to $96 million in additional revenue in the next fiscal year.

Cronk said the overall outlook was buoyed by unexpected increases in sales taxes. The city saw a 16% increase in sales tax revenue during a pandemic-era rebound that sent $328 million into city coffers, nearly $50 million above projections.

The bulk of budget dollars in the general found would go toward police, fire and emergency services, with the three departments accounting for $785 million of the budget proposal. The general fund pays for all city services and operations.

Of that fund, 35% is slated to go to the Austin Police Department, 18% to the Austin Fire Department and 9% to emergency services like Austin-Travis County Emergency Medical Services. All told, APD will see another record-high allocation. Last year, state lawmakers passed a law banning cities and counties from reducing police budgets. That measure targeted Austin’s 2020 decision to cut its police budget and reallocate money toward alternatives to traditional policing.

The budget proposal also aims to raise the city's minimum wage from $15 an hour to $18. Cronk said he hopes a raise will help the city retain and recruit workers amid staffing shortages, and that it's in keeping with the Austin City Council's ultimate goal of paying city employees at least $22 an hour.

This is not, by any stretch, a final draft of the budget. The city will hold two meetings to gather input from Austin taxpayers, one on July 27 and another on Aug. 2. Districts 2, 3, 6, 7 and 10 will also have their own in-district opportunities for folks to weigh in. More information on those meetings is on the city's budget website.

After that, the budget will go to the Austin City Council in August for approval. The city's fiscal year starts Oct. 1.