Banking

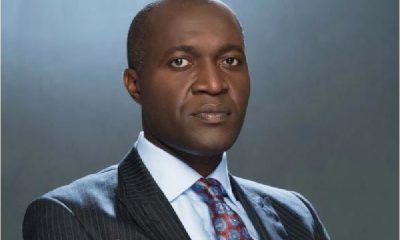

Ogbonna Tasks Banks to Close African MSMEs $120bn Trade Finance Gap

By Aduragbemi Omiyale

The chief executive of Access Bank Plc, Mr Roosevelt Ogbonna, has underscored the potential for Africa to reframe its narrative, urging countries on the continent to embrace their strengths.

The banker also reinforced the importance of private sector involvement in regional trade, particularly for micro, small, and medium-sized enterprises (MSMEs).

According to him, “Africa’s MSMEs are the backbone of its economy, yet they face a trade finance gap of around $120 billion. Financial institutions must innovate to close this gap and provide the liquidity these businesses need to grow and scale.”

Mr Ogbonna was one of the panellists at the just-concluded Africa CEO Forum held in Abidjan, Cote d’Ivoire.

The event brought together leaders from across the continent to discuss the critical role of private sector-led growth in the development of African trade and market integration under the topic Fast-tracking African Integration: The Private Sector Imperative.

During his presentation, Mr Ogbonna said, “Years ago, if you told someone something was made in China or Taiwan, it was often seen as inferior. Fast forward 30, 40 years, and now Made in China is a symbol of quality, and Made in Taiwan commands respect globally.

“The difference? These countries built a strong domestic market that allowed them to scale, build proficiency, and innovate. Africa is no different.

“We have everything we need, from abundant raw materials and vast natural resources, to a youthful population and fertile land. There is no reason why Africa has not yet transformed itself into the powerhouse we know it can be.

“Africa has what it takes to win, and my charge remains the same as I gave during our inaugural Africa Trade Conference in South Africa: Buy Africa, it’s not inferior!”

Echoing Mr Ogbonna’s sentiment at the gathering were the Secretary General of the African Continental Free Trade Area (AfCFTA), Wamkele Mene; and the president of Africa Finance Corporation (AFC), Samaila Zubairu, who highlighted the tangible steps taken to drive integration, such as the introduction of the e-Tariff Book and the AfCFTA Adjustment Fund, as well as the critical need for synergy between public and private investment to address Africa’s infrastructure gaps and finance its development priorities.

The discussion also focused on the barriers preventing the scaling of intra-African trade, notably the lack of adequate logistics and transport infrastructure. The Pan-African Payments and Settlement System (PAPSS) was highlighted as a potential game-changer in unlocking new cross-border trade opportunities by facilitating smoother payments and transactions.

They were all united in their belief that Africa’s transformation hinges on the development of regional value chains, the scaling of intra-African trade, and the need to build both financial and infrastructural capacities that will enable economic integration.

Banking

Interswitch, Bank of Sierra Leone Champion Financial Inclusion

By Modupe Gbadeyanka

The duo of Interswitch and the Bank of Sierra Leone (BSL) recently facilitated the coming together of key stakeholders across the financial ecosystem to chart a course toward broader access, inclusion, and growth through digital payments.

They partnered to support the second edition of the Sierra Leone Fintech Forum held at the New Brookfields Hotel in Freetown.

Present at the event themed Access, Inclusion and Growth – Deepening Digital Payments in Sierra Leone were senior representatives from both the public and private sectors, including regulators, banks, fintechs, mobile money operators, and development organisations.

The programme was organised to accelerate Sierra Leone’s digital finance transformation and in his keynote address titled Building on Progress: Expanding Access, Driving Inclusion, and Fueling Growth for National Prosperity, the Managing Director for Payment Processing and Switching (Interswitch Purepay), Mr Akeem Lawal, reinforced the company’s commitment to co-creating value in the markets it serves.

He said, “Financial inclusion goes beyond launching more apps or issuing more cards, it’s about solving real problems with solutions that are scalable, secure, and grounded in local realities.

“Since the first edition of the Fintech Forum, Sierra Leone has made clear progress, with strong mobile penetration and a forward-looking central bank. What’s needed now is execution that is sustained, coordinated, and responsive to the realities on the ground.

“By applying lessons from multiple African markets and tailoring them to local needs, Interswitch is committed to supporting Sierra Leone’s digital transformation. That means enabling agency networks that function effectively, driving merchant acceptance to reduce cash reliance, and working closely with regulators to co-create policy that drives real progress and inclusive growth.”

In his remarks, the Governor of BSL, Mr Ibrahim Stevens, commended Interswitch’s continued investment in the country’s digital transformation journey, highlighting the regulator’s commitment to driving regulatory innovation and building an inclusive ecosystem.

“The Bank of Sierra Leone recognises the critical role of digital financial services in building a more inclusive and resilient economy. Events like the Sierra Leone Fintech Forum, in collaboration with innovators like Interswitch, help accelerate the adoption of technologies that bring more Sierra Leoneans into the formal financial system.

“We remain committed to creating an enabling regulatory environment that fosters innovation while ensuring consumer protection and financial stability,” the central bank chief stated.

A key highlight of the forum was the live demonstration of Interswitch’s Agency Banking solutions, designed to bridge the gap between traditional banking infrastructure and underserved and remote communities.

Attendees experienced firsthand how the platform supports secure, efficient, and accessible financial transactions across Sierra Leone through a decentralised network of agents.

The event featured a series of insightful panel discussions, interactive Question & Answer sessions, and networking opportunities, fostering collaboration and knowledge exchange across the ecosystem.

As mobile connectivity expands and Sierra Leone’s digital agenda accelerates, the forum provided a timely platform to align actors, surface practical solutions, and build collective momentum toward a more inclusive financial system.

Banking

Fidelity Bank Shares Food Packs to 1,500 Rivers Inhabitants

By Modupe Gbadeyanka

Residents of Ihie Town in the Etche Local Government Area of Rivers State were recently overjoyed when Fidelity Bank distributed food packs to over 1,500 individuals.

The food distribution in Ihie town was executed in partnership with The Reach Nigeria Foundation, a non-profit organization focused on sustainable development.

The initiative was a strong demonstration of the commitment of the financial institution to community development and poverty alleviation under its Food Bank programme launched in April 2023.

It is part of the bank’s broader corporate social responsibility drive aimed at combating hunger and improving livelihoods across Nigeria.

The scheme also perfectly aligns with the United Nations’ Sustainable Development Goal 2 which aims to achieve zero hunger.

Speaking at the donation event, the Regional Bank Head for Rivers/Bayelsa 1 & South Commercial at Fidelity Bank, Mr Ibisiki Eretoru, noted that the success of the lender is essentially linked to the well-being and prosperity of the communities in which it operates.

“The Food Bank Initiative is our way of contributing to the well-being of our host communities through regular food support. Each month, with the support of our network of dedicated partners, we distribute food packs to individuals and families across the country,” Mr Eretoru said.

“To date, we have distributed over 200,000 food packs through similar outreaches aimed at supporting individuals, strengthening businesses and transforming entire economies,” he added.

Also commenting, the chief executive of The Reach Nigeria Foundation, Ms Benedicta Ibiyemie Ayarete, disclosed that the community was selected due to its need for food support during the post-planting and pre-harvest period.

“Though Ihie is an agrarian community, we identified it as needing food support at this time. The peaceful nature of the community also makes it a viable location for Fidelity Bank to sustain and grow its presence. We are proud to be part of the meaningful impact of this outreach on the people,” she explained.

Expressing his gratitude, the paramount ruler of Ihie community, Eze Richard Amadi, commended the bank’s timely intervention, describing it as “a stitch in time” and a noteworthy effort that addresses the needs of the people.

Also speaking at the event, Chairman of the Ihie Community Development Committee, Mr Stephen Asoh, expressed appreciation to Fidelity Bank, highlighting the positive difference the donations will make in the lives of many residents.

One of the beneficiaries, Mr Mike Okere, praised Fidelity Bank for the initiative and called on other financial institutions to emulate the bank’s approach to community engagement and impact.

Banking

Unity Bank Urges Secondary School Students to Cultivate Savings Culture

By Modupe Gbadeyanka

Secondary school students across the country have been charged to give priority to financial management, investment and savings culture because of tomorrow.

This advice was given by the chief executive of Unity Bank Plc, Mr Ebenezer Kolawole, while commemorating the 2025 Global Money Week.

He said the lender remains committed to deepening financial empowerment targeting youths, helping them to taking the right financial decisions, particularly in an era shaped by social media influence and digital distractions.

At an impactful session at Boys Model Secondary School, Owerri, Imo State, Mr Kolawole, represented by the company’s Zonal Head of South South/South East, Mr William Odigie, shared practical lessons on financial responsibility, advising against any impulsive financial behaviours, more especially those involving online.

Held under the theme, Think before you follow, wise money tomorrow, the banker emphasised the importance of being exposed early to financial management.

“The habits you form now around saving, spending, and investing will shape your financial future. It’s not about how much you have, but how wisely you manage it,” he stated.

In each of the 13 schools visited nationwide, Unity Bank’s facilitators engaged students in interactive discussions, practical money management exercises, and quizzes.

Participating students who displayed exceptional skills at various sessions got recognition and were presented with branded gift items to strongly reinforce the financial literacy training.

Recall that recently, Unity Bank launched GenFi digital banking app, a youth-focused solution designed to empower children and teens with smart money habits through gamified learning, goal-setting, and parental guidance. The participation of the Bank in the financial literacy training marks this year’s Global Money Week is to further Youth engagement.

Global Money Week is a worldwide initiative coordinated in the country by the Central Bank of Nigeria (CBN) in collaboration with the Bankers’ Committee and Junior Achievement Nigeria. The engagement aims to instil sound financial knowledge and habits in young people from an early age, being a strategy to promote financial inclusion.

Unity Bank has continued to invest in youth-focused financial education as a clear demonstration of its unwavering commitment to empowering Nigeria’s next generation for financial independence and self-reliance.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN