Martin Lewis surprised the studio audience on his ITV show with a warning about children paying tax - with many unaware of the rule. The financial expert explained on The Martin Lewis Money Show Live this week the rules around giving your kids money and when it becomes taxable.

As he asked the audience about whether children have to pay tax, almost everyone in the studio raised their hands to indicate that they don't. However, the MoneySavingExpert founder revealed that they, in fact, do pay tax - and there is a limit to how much money you can give them tax-free.

Martin explained children are legally considered 'taxable entities' by the government, which means money they earn can be taxed. Children can legally work from the age of 13 - though the hours and days are limited until they turn 16.

READ NEXT: Martin Lewis' warning as broadband and phone price hikes confirmed

But at any age, a child's earnings are subject to tax - including any money gifted to them, reported YorkshireLive. Martin said: "This is important to understand. If the money you give them earns over £100 interest per year, and that's per parent, then it would be taxed at the parent's rate, not at the child's rate.

"Now on current top easy access that's about £2,500. If you give them over £2,500... then you're going to be over £100 of interest generated. Now why is this done? Well it's easy, it's so you don't stash all your money in your kid's name and use their tax-free allowance as an easy tax loophole."

He added: "But, what do you do about it? Well, if they're gonna earn more than £100 and you pay tax on savings then that's where a Junior ISA comes into its own."

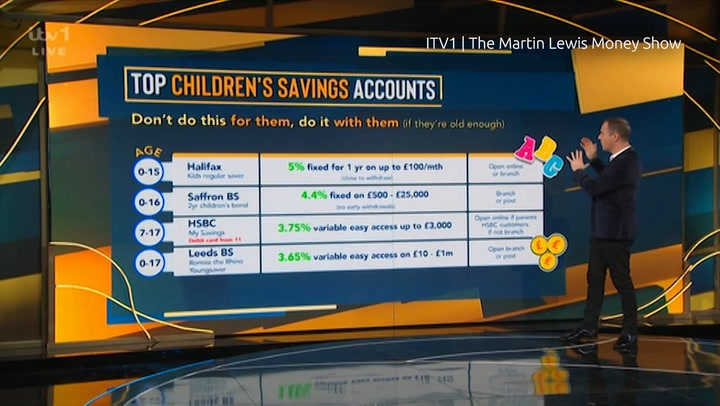

The money guru said a Junior Individual Savings Account (ISA) gives you tax-free savings for your kids for up to £9,000 per year. He urged viewers who have one to "check the rate" because if it's lower than other providers, you can transfer it without losing tax-free status.

Martin said many people could be missing out on interest because of having poor. However, he explained the downside of a Junior ISA is the money can't be taken out until the child turns 18 - and at that point they have control over it.

He added: "On their 18th birthday, the money is theirs. It is not the parents', it is not the grandparents', so let me be plain about this: When your child is 18 and you've been saving for its university income and it decides it wants to go on a smoking weekend in Amsterdam, it is their choice, not your choice. So be aware that is the rule."

READ NEXT:

Martin Lewis says every mobile phone owner should send these two texts

Leicestershire water bills to rise by £31 a year in largest increase for nearly 20 years

DWP urges pensioners not to miss out on £3,500 a year income boost

Martin Lewis' warning to check payslip to see if you're losing money

Hard-up pension savers have wrongly overpaid £1bn in taxes to HMRC