Update: The financier Ivan Boesky died on Monday, May 20, 2024. His sister Marianne Boesky confirmed the news earlier today to the New York Times. The below article appeared in the December 2016/January 2017 issue of Town & Country.

He really did say greed is good—and was applauded at a Berkeley business school graduation in 1986. The line would be immortalized in Oliver Stone's Wall Street by Gordon Gekko, the perfect hero/villain for the Decade of Greed. And while that's every decade on Wall Street, in the 1980s the unapologetic pursuit of money became a sacrament. At the apex of his renown, before his spectacular fall, Ivan Boesky parlayed a 10-year run of bafflingly prescient stock picks (using his wife Seema's money) into finance superstardom, with laudatory magazine profiles, a book deal, and lecture invitations from the best business schools.

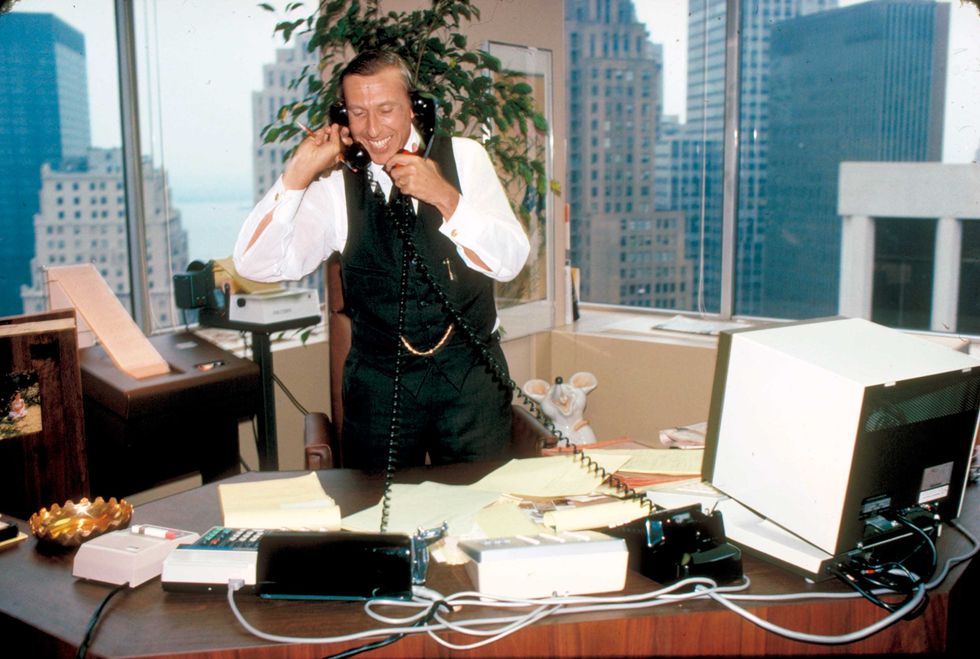

Boesky sat at the epicenter of the hostile takeover/leveraged buyout/junk bond bonanza. As an arbitrager, or "arb," his job was to buy stocks of undervalued companies likely to become takeover targets. It required a voracious intake of information and had him on the phone almost daily with every major player in the Wall Street mergers and acquisitions fraternity—investment bankers, lawyers, private equity moguls, and other arbs. As the '80s progressed and deals grew in number and size, fueled by Michael Milken's money machine at Drexel Burnham Lambert, Boesky's profits skyrocketed, along with his social aspirations.

Like many other Reagan-era parvenus, the Boeskys conspicuously consumed the spoils of genteel wealth—but, never having been close to the real thing, they were betrayed by their immutable tackiness. Ivan, son of a Detroit strip club owner, and Seema, daughter of a real estate developer, bought Charles Revson's Bedford, New York, estate, then put in carpeting monogrammed with their initials. Ivan never graduated from college but made a large donation to Harvard so he could invite people to the Harvard Club (which he thought carried social cachet) and mislead his guests into thinking he had attended.